Failing to Plan is Planning to Fail!

This article was featured in the Spectrum Analysis email newsletter sent on 23 July 2020.

Peter Buckingham is the Managing Director of Spectrum Analysis Australia Pty Ltd, a demographic, mapping, franchise territory planning and statistical analysis consultancy. Peter is the Go To person as to how to establish territories in Australia and overseas. Peter runs the FCA courses in this area: Franchise Territory Planning. To contact Peter, email peterb@spectrumanalysis.com.au or visit www.spectrumanalysis.com.au.

Whilst the title of this article is an oldie, it always remains a truism of life.

From a Franchisors’ point of view, it should be one of the stable quotes you roll out time and again to the Franchisees at many a conference and gathering, but do you apply the same rules to your own business – in many areas?

I wish to address this in terms of one of the biggest investments your Franchise system ever makes – the property portfolio.

Most systems fly or die based on the quality of their stores if they have bricks and mortar retail. Whether it is in the locations that are chosen within shopping centres, the locations along a shopping strip, or along a main road, success is often measured on the customer seeing, remembering and visiting your store again and again.

I would like you to ask yourself the questions as far as your property portfolio is concerned under specific

headings:

- How many sites should we have Australia wide?

- How should these be broken down by major city and regional area?

- How big is our trade areas, and therefore how far apart do we need to have the stores to minimise cannibalisation to a reasonable number?

- What areas should be best for our business?

- Where are the good areas that we are currently not in?

- Where is the growth of the cities to keep up our representation?

If you can understand the above, and put them into your Strategic Network Plan, a document all senior management are on board with, you should be heading in the right direction.

One quote I always use is to be Proactive and not Reactive in establishing your store network. Proactive is where you know where you want to go to open stores. Reactive is the Leasing Agent telling you where they have a store for rent!

Let’s start with Australia in 2020

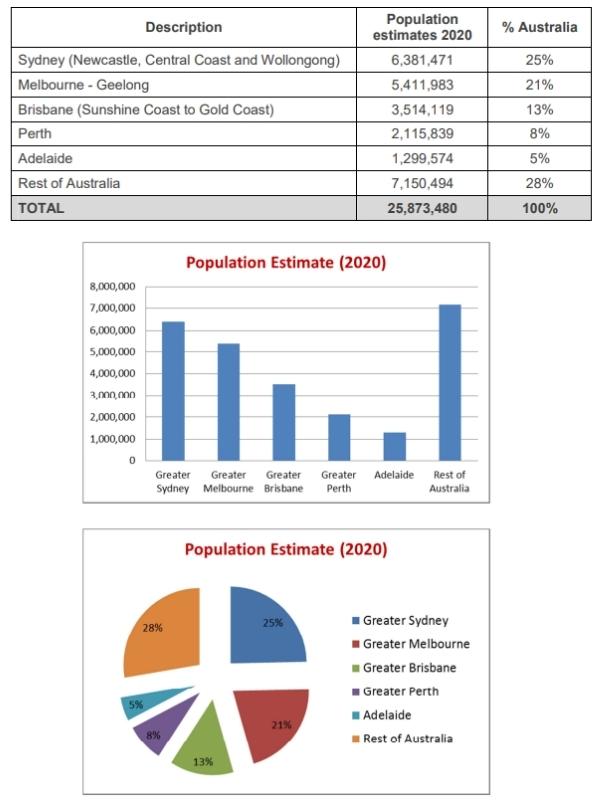

The ABS provide population estimates in 5 year increments well into the future. The most recent set released gives us estimates from 2017 – 2032. Based on the latest data in 2020, the best estimates are:

Australian Bureau of Statistics (2017-2032)

If we use these ratios as an indicator for stores or territories, we create some proportion of what we should

require in each city to create similar penetration for our brand. Regional areas and smaller cities can also

be addressed as required, but may not be able to support the same proportion often due to the tyranny of

distance.

How can we measure our trade areas?

It is great saying you can have 100 stores or territories in Sydney, but if this leaves them about 4 kms apart, and they actually draw from a large area, then they will be greatly overlapping and cannibalising each other – Perfect recipe for a Franchisee dispute and court case.

Some businesses can be very tight, and for example we did some work for a 24 / 7 gym. They found that in most cases around 60% of their customers came from within a 2 km radius. Logic is you often walk to the gym, or want to have a very short drive. On the other hand a bulky good store in say Nunawading (Melbourne) would probably need to go around 8km radius to cover 60% of their customers.

The way to measure this is to plot the customer’s addresses, and see how far out you need to go to get about 60% in the circle. Rough number is that a bit under twice that distance should be how far apart the stores should be apart.

Much of this can be done by geocoding using computers, and no longer relies on you sticking 1,000 pins into a map, and trying to count them.

What areas should be best for our Brand?

In doing a Strategic Network Plan, you want to be opening the stores in the most suitable areas from a demographic point, and maybe never going into the areas of low attraction to your brand, or if so, under careful circumstances.

Knowing your customers can be translated into demographic measurements, and these can then be applied using mapping across all markets, to see the areas of best opportunity. An example may be an Asian tea brand, and we know it is very popular in Korea, Japan and China. Obviously looking for the areas showing in the census as born in Asia, or high % of people speaking Asian languages at home will

be better than areas predominantly speaking English at home. All this can be mapped accordingly.

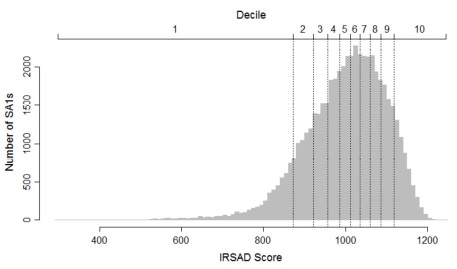

Many brands feel they are best suited to a specific socio economic range, which is quite logical. There is a very broad, ABS provided dataset called SEIFA – Socio Economic Index For Areas that quantifies the area, based around an Australian average of 1,000, and one standard deviation being 100.

This score allows us to compare areas from city to city, and still have confidence in its similarity and potential spending powers.

If you know your product sells best in lower or middle areas, then make sure you have them all covered Australia wide. Maybe the example could be cars, and where would you set up Bentley dealerships, BMW dealerships and then Hyundai dealerships? Let SEIFA be the quantitative way of finding similar areas to where you are already successful.

Where are the areas we are not in?

If we map our stores, identify the area’s best for our brand (SEIFA or some other demographics), then we should be able to get a good visual on areas of opportunity.

Where are the growth corridors of the major cities?

Most of us know our own city, but are often far weaker in our knowledge of the other main capital cities. The ABS provide data that we can have mapped to show the expected growth corridors 5, 10 and 15 years into the future, and many large companies like the oil companies and McDonalds look to purchase / secure land even before the services go in, as a proposed site 5 – 10 years into the future.

Conclusions

If you want long term success in your business, planning around the property aspect of the business is a must. Either internally or with an external consultant, creating a Strategic Network Plan is a bit like taking out insurance on the business, or by thinking about these things and being proactive, you are hopefully improving the chances of success for the long term future, rather than being reactive and following the herd mentality.

If you think leasing agents are working in this manner, you are more optimistic than I am (and I was a property manager for Caltex for three years). They will offer you locations they have available and best suit their customer – the Lessor / seller of the property. Be proactive and develop a Strategic Network Plan for the growth of your retail network and your business in general. The costs involved, whether they be internal or external consultants, will probably be less than 10% of the cost of one failure in your growing network.

Think of it as an investment and not an expense, and not a bad investment in my view.