Franchise locations: how far away is too close?

When you are about to buy a franchise you must look at the competition both from other companies, and from the franchise brand, and ask yourself, what is a reasonable distance between store locations? How far away is too close?

Competitors are not normally a great problem, and in fact, as in the case of homemaker centres and certain types of shopping centres or shopping strips, neighbouring competition can actually be an advantage.

This is what we call “clustering”. Name a reasonably sized homemaker centre or precinct, and count the bed stores, furniture outlets and electrical retailers all in the same area. Experience has shown that these retail outlets actually work best together, as the combined drawing power of the homemaker centre far outweighs the advantage of being out on their own.

Over the years we have called this ‘friend and foe.’ In many businesses – including quick service restaurants (QSRs) and direct factory outlets (DFOs), being with others makes for a precinct, and therefore is an advantage (friend). Being out on your own makes everyone else a foe.

That works well for competitive brands but you obviously want minimal competition from your own franchise that will negate any brand advantage you may have over the opposition.

In the fuel industry, it is accepted that 75 percent of the sales for a new site will come from other sites in a 3km radius – the balance being the transient volume that moves just because they need fuel at the time.

In businesses like Lottery sales, the 75 percent of business comes from sales within 2kms, and when you look at the concentration of Lottery agencies, you can see that they compete with each other on a very regular basis.

Many franchise chains have market needs similar to the beds, furniture and other homemaker retailers, and the relevant travel distance is far larger than those mentioned above.

So how can we deduce what is fair and reasonable?

So the issue is one where a potential franchisee wants half of Australia as a Preferred Marketing Area (PMA), and the franchisor is trying to rationalise this to make an acceptable PMA which will allow a reasonable number of stores within each market.

So how do we use data and analysis to find an answer?

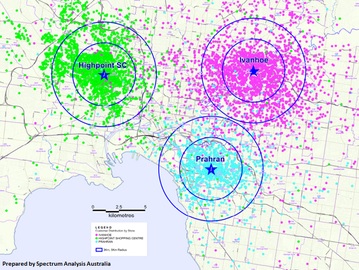

Customer mapping

The first thing we suggest when the issue is raised is to ask for and map the customer database. Once we have this mapped, our analysis involves looking at what radius we need to go out from the store to enclose 60 percent and 80 percent of the customers. Our view is a reasonable measure of the PMA is somewhere in between.

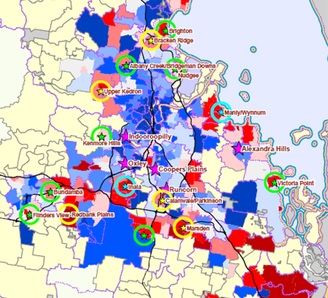

In many cases we are asked to map the customer database of 10 or 20 stores, and come to a realistic conclusion as to what is a reasonable PMA in:

High Density Areas – normally more than 100,000 people in a 3km radius eg Bondi, Mosman or Neutral Bay in Sydney, Elwood, South Yarra, Richmond in Melbourne

Middle Suburbia – normally a population density of about 60,000-80,000 individuals in a 3km radius. For instance, the middle suburbs of Melbourne and Sydney, anywhere in Adelaide or Perth, and most of Brisbane

Outer Metro areas – normally with a population of fewer than 40,000 people in 3kms; outer metro growth areas such as Cranbourne, Doreen, Kellyville, Albion Park, Helensvale.

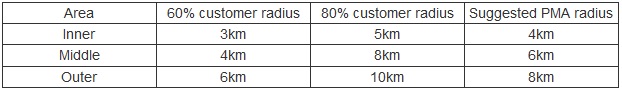

Often this type of process for many brands may look like:

So if we think of two adjoining sites, we normally accept the two suggested PMAs can overlap somewhat. In the inner area, we would probably be looking at separating sites about 5-7kms away from each other, sites in middle areas should be about 8-10kms apart, and outer metro locations at a distance of about 12-14kms.

If you think in terms of a large market like Sydney (Newcastle to Wollongong), this will probably generate about 40 locations, for Melbourne (to Geelong) close to 32, and Brisbane (toSunshine and Gold Coasts) around 20.

The reality is most franchisees fear other branded sites from within the network far too much. History has shown us that when another store opens within a few kilometres, this can be the excuse they use to say that the sky is falling, and expectations of 50 percent loss of business in reality may only be 10 percent (which is still not great).

In fact we look at sales of clients before and after a new store opens, and sometimes we are amazed that when the new store opens, the existing nearby store increases sales as well. Maybe this is because the increased market presence of two stores, which brings more advertising and action within the brand, outweighs the cannibalisation issue?

My view is that the franchisor needs to accept responsibility for PMAs and have some logic for answering any questions posed by a potential franchisee.

Summary

Facts and data can answer these common questions, and if you are being told the cannibalisation effect will be zero or very small, ask the franchisor for the logic behind this argument, and do not just accept a generic response without any formal and verifiable reasoning. All franchisees need to make informed decisions.

Contact Spectrum Analysis if you would like more information or advice.